Barbados at COP 28

The Bridgetown Initiative

Urgent and Decisive Action to Reform the International Financial Architecture

The Bridgetown Initiative seeks to accelerate progress towards the achievement of the Sustainable Development Goals and the Paris Agreement.

It provides for immediate liquidity support, restores debt sustainability, mobilises private sector investment, increases overall sector development lending for the SDGs, ensures that the multilateral trading system supports a green and just transition, reforms the governance and operations of MDBs and IFIs.

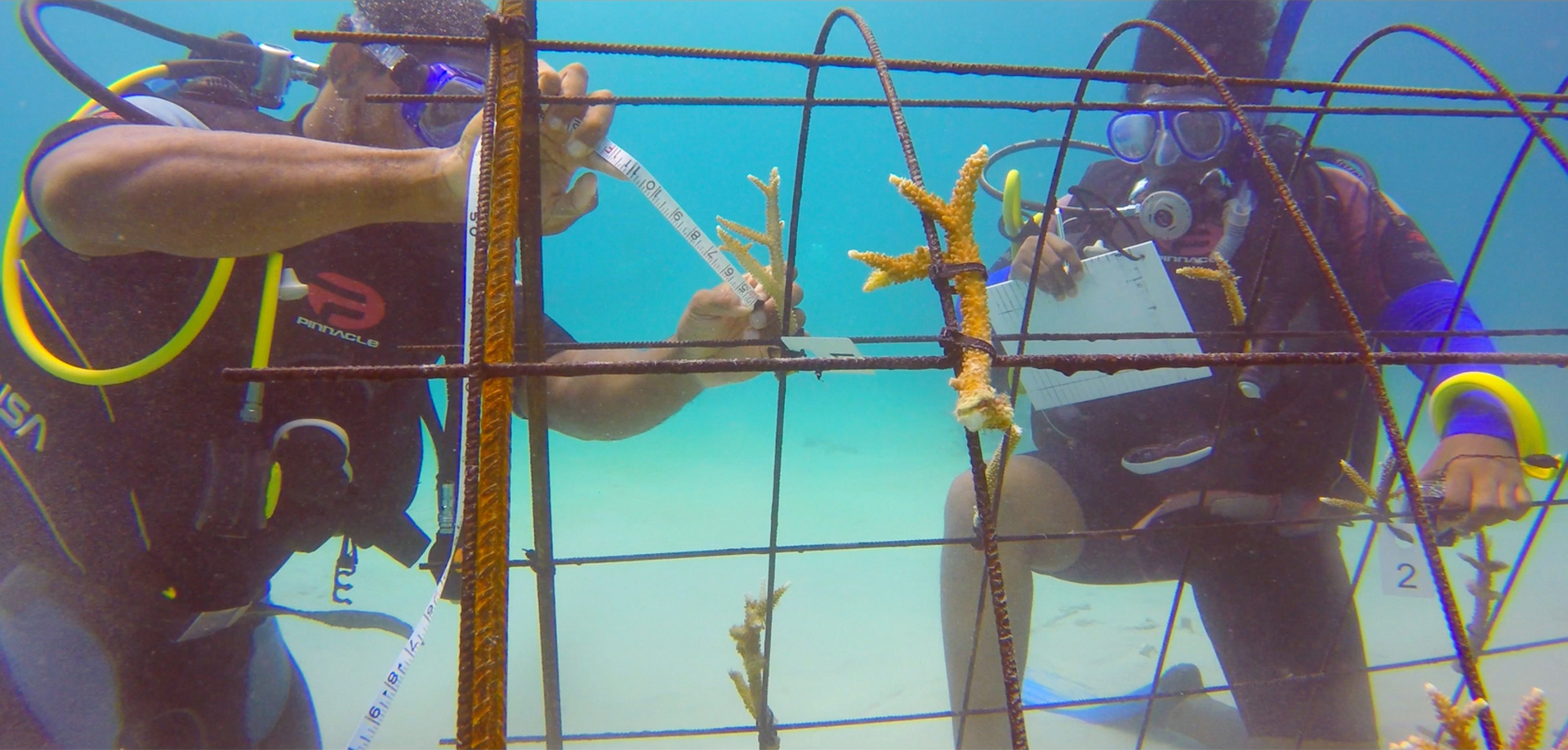

The Roofs to Reefs Programme (R2RP)

The Roofs to Reefs Programme (R2RP) is a holistic, integrated national initiative for the resilient development of Barbados. It provides for a response at the individual, community and country levels. It is an integrated investment programme founded on the principles of sustainable development and climate change resilience and represents the development model for Barbados for the next decade. It is primarily a physical development programme focusing on built environment/ infrastructure and nature/ecosystems, that will play a supporting role in further development of the policy framework as needed to meet the objectives.

Missed an Event? Catch the Replay

Opening the Barbados Pavilion

Bridgetown Initiative Series

VIDEO – Bridgetown Initiative Series – SDRs: A Golden Climate & Development Tool or A Distraction

VIDEO – Bridgetown Initiative Series – Funding Loss and Damage due to the Effects of Climate Change

VIDEO – Bridgetown Initiative Series: Unblocking the green transformation in developing countries with a partial foreign exchange guarantee

VIDEO – Bridgetown Initiative Series: How to finance climate resilience (And tripling MDB lending)

Partner-Cohosted Events

To Pause or Not to Pause: Making the global financial system more shock-absorbing by spreading pause clauses into all financial instruments.

Date: 4 December 2023 | Time: 03:00 p.m. (UAE time) | details may be subject to change

Venue: The Barbados Pavilion at COP28

The failure of big emitters to mitigate greenhouse gas emissions and support adaptation financing has led to a steep rise in climate-related loss and damage. The IPCC estimates that loss and damage today is over $150bn per year and will likely double in a few years to over $350bn per year. Whether or not COP28 agrees to operationalise a loss and damage fund, it is unlikely to offset this scale of losses soon.

When disasters strike, countries are faced with three compounding problems:

- The economy, income and livelihood stop.

- There is an enormous need for cash for rescue, stabilisation, and immediate recovery.

- Partly as a result of these two, the existing lenders and the financial markets expect the country to default. The currency or reserves or both come under pressure, requiring higher interest rates

in defence, which worsens the climate for financing. Developing countries have no recourse to quantitative easing or expansive central bank swap lines with the US Federal Reserve. Policy space collapses when it is needed more acutely.

Climate-related debt clauses, or hurricane-clauses in bond instruments or, more simply, "pause clauses", were born into this space. The original designers, Sebastian Espinosa and David Nagoski of White Oak Debt Advisors, first put them into the restructured bonds of Grenada, then St. Kitts & Nevis and most recently Barbados, which became the world's largest issuer of pause clause inclusive sovereign bonds.

Pause clauses are not insurance; this is not a ‘bet’ on an event taking place. When a triggering event occurs, debt servicing is paused for two years, then added back on at the original interest rate

afterwards so that the borrower and creditor are no worse off. They are, critically, Net Present Value neutral; there has just been a shuffling in the timing of payments.

Many have responded positively to the call for the spread of pause clauses under the Bridgetown Initiative, most notably at the Paris Summit, the UK and US export credit agencies, the World Bank and IDB. There remain, however, many critical and evolving design questions as we try to broaden the adoption of these clauses by private and not just public creditors.

In this session of the Bridgetown Initiative series at the COP28 Barbados Pavilion:

Avinash Persaud will kick off the discussion by describing the context, the problem these clauses solve, and the problem they do not solve. He will invite the original architects to describe the latest generation of pause clauses and what they think are the good and bad trends in this space before going to an expert panel for their thoughts on whether and how these clauses should be spread further.

Speakers / Panelists

- Moderator: Avinash Persaud, Barbados Special Envoy on Climate Finance

- Meg Nicolaysen - Deputy Director – Climate Change and Sustainability, UK Export Finance

- Juan Pablo Bonilla, Manager of the IDB's Climate Change and Sustainable Development Sector (CSD)

- Ramzi Issa - Managing Director at UBS

Unblocking the green transformation in developing countries with a partial foreign exchange guarantee

Date: 6 December 2023 | Time: 11:00 a.m. - 12:30 p.m. (local time) | Venue: The Barbados Pavilion at COP28 | https://www.investbarbados.org/cop28/

Background

The problem: although rich countries contributed 70% of the stock of greenhouse gases causing global warming, developing economies now contribute over 63% of greenhouse gas emissions, and this figure is rising. There is no pathway for the world to remain below critical climate tipping points that does not include an accelerated investment in the green transformation of emerging economies. The 2022 report of the Independent High-Level Expert Group on Climate Finance estimated that by 2030 annual investments exceeding US$2.4 trillion are needed, of which, given the scale and limits of domestic resources, up to US$1 trillion will need to be foreign private investment.

However, outside of China, the cost of capital in developing countries is significantly higher than in developed countries, almost always two or three times the cost in developed economies. In one stark example, the South African Government recently offered investors 12% annually when it borrowed ten-year money, while the German Government paid 1%. The high cost of capital in developing countries means we are only seeing a trickle of the necessary foreign private investment. Unless we lower the cost of capital in the developing world, the needed transformation will not materialise.

Unpacking the causes: to address issue, we need to understand why the cost of capital is so much higher in developing countries, understanding that, in general, the cost of capital reflects the rate of return investors require to compensate for perceived risk. An in-depth analysis using data from major emerging economies finds that macro risk or country risk is the greater contributor to the problem than micro risks or project risk. Further analysis finds that in the common practice of ‘foreign exchange hedging,’ investors are essentially overpaying for foreign currency risk, which may be viewed as a proxy for overall country risk.

Action for impact: an FX Guarantee Mechanism is conceptualized to target this issue in a manner that makes a critical shift, making otherwise unfavorable projects favourable, with the potential to be upscaled to play a major role in unblocking private finance flows for the green transition in developing countries. In keeping with the overall approach of the Bridgetown Initiative, this proposal aims for high impact by identifying and targeting a major contributor to the problem.

In this session of the Bridgetown Initiative series at the COP28 Barbados Pavilion:

Avinash Persaud, one of the architects of the Bridgetown Initiative, will kick of the discussion with an overview of the proposed FX Guarantee mechanism, following which he will engage a panel of experts to further dissect the problem, the proposed solution, and the path forward, wrapping up with live Q&A in the Barbados Pavilion.

Speakers / Panelists

- Opening remarks: Dr. Pepukaye Bardouille, Director – Bridgetown Initiative Unit, Barbados

- Katherine Stodulka - the Director of the Blended Finance Taskforce at SYSTEMIQ

- Barbara Buchner - Global Managing Director, Climate Policy Initiative and member of the IHLEG

- Anderson Caputo, Division Chief, Connectivity, Markets and Finance - Inter-American Development Bank

Funding loss and damage due to the effects of climate change

Date: 8 December 2023 | Time: 11:00 a.m. (UAE time) | details may be subject to change

Venue: The Barbados Pavilion at COP28

Background

The IPCC and the Independent High-Level Expert Group estimate that loss and damage related to climate change already here or in train is over $200bn annually, with countries in a band around the equator experiencing loss and damage four times greater than elsewhere. Further, unless we mitigate and adapt faster than currently, estimated loss and damage will likely rise over $350bn per year by 2030. Already indebted climate-vulnerable, due to expected rising future losses, face weaker credit ratings and sliding investment flows and a pressing need to invest heavily in climate resilience, adding to heavy debt burdens.

A historically significant breakthrough at COP27 was the agreement to establish a Fund for developing countries particularly vulnerable to climate change to address climate loss and damage. But how will the Fund be funded, who will be eligible, and how will it provide support? The 24-strong Transition Committee established by COP27 to operationalise and establish funding arrangements for the Loss and Damage Fund has met five times, including an additional extraordinary meeting, to address these questions and inform the negotiations at COP28.

Debt, justice and equity lie at the heart of loss and damage for developing countries and many global citizens. The discussions, inside and outside of negotiations, have been complex, difficult, and intense. Where do we go from here?

In this session of the Bridgetown Initiative series at the COP28 Barbados Pavilion:

Professor Avinash Persaud, a member of the Transition Committee negotiating the new Fund for Latin America and the Caribbean and an architect of the Bridgetown Initiative, will lead an open discussion with a small panel of experts and a live audience on a viable pathway to operationalising a Fund that could historically move us forward. We bring together a variety of perspectives from developed and developing countries to the discussion.

SDRs: A Golden Climate & Development Tool or A Distraction

Date: 3 December 2023 | Time: 03:00 p.m. - 04:00 p.m.(local time) | Venue: The Barbados Pavilion at COP28

Background

Special Drawing Rights or SDRs were introduced by the IMF in 1969 in response indications of problems ahead with the Bretton Woods exchange rate system. The underlying premise was that when a country's balance of payments was coming under pressure and reserves were falling, reserves were rising somewhere else in the system - most likely in the countries whose currencies were used to purchase goods internationally. If all countries had special drawing rights on the central bank reserves of others, countries with declining reserves could borrow from those with rising reserves, buying time for a less painful balance of payments adjustment. If this was not overdone, SDRs made the system more shockabsorbing and resilient to adverse market speculation, buying time for re-balancing through expansion and not contraction.

When the Bretton Woods exchange rate system collapsed in 1973, SDRs, being associated with this system, were left to languish. After the initial issuance, there were no new issues of SDRs until were used successfully as a short-term crisis tool, first in the Global Financial Crisis of 2007 – 2011, and then at a larger scale during the COVID19 pandemic. In a call led by French President Macron, the Bridgetown Initiative, and the 'Paris Pact', a number of rich countries have "rechanneled" 30-40% of their surplus SDRs to two IMF Trusts. The Poverty Reduction and Growth Trust and the new Resilience and Sustainability Trust have used these SDRs to lend cheaply to developed countries.

SDRs are a right of one IMF member central bank to borrow from another - on the most accessible terms –so they are a debt instrument, not cash, and have no standing and value outside central banks. In modest quantities, SDRs are a reserve asset, because when a country with capital outflows is using its SDRs to borrow reserves from a country with capital inflows, the receiving country gains by being able to lend out something that it has too much of at that moment. But one could imagine some level of SDR issuance where a surplus country feels that lending out so much of its reserves compromises its safety. We are a long way from that limit, and there is scope for more SDR issuance, but we don't know exactly where it is, and it is unlikely to be a static figure.

So, there are many things SDRs cannot be used for because it is a form of debt between central banks that needs to be repaid. But having more of them would help developing countries address a new world of more significant, frequent shocks, primarily due to climate change and its broader impacts on health, trade, and the economy. Several critical questions come to mind, related to quantities, issuance timing, systemic biases, and potential broader uses for SDRs.

In this session of the Bridgetown Initiative series at the COP28 Barbados Pavilion:

Avinash Persaud will open and moderate a discussion with leading experts on better use of SDRs for global development. We will identify and explore the critical underlying questions, then bring it all together to answer the main question of the session – are SDRs a golden climate and development tool or a distraction?

Speakers / Panelists

-

- Jean-Christophe Donnellier - Inspector General at the French Treasury, Chief of the Internal audit, Green Climate Fund Board Member

- Amar Bhattacharya - Senior Fellow, Global Economy and Development, Brookings Center for Sustainable Development, Executive Secretary of the IHLEG

- Gustavo De Rosa, Vice President for Finance - Inter-American Development Bank

- Moderator: Avinash Persaud, Barbados Special Envoy on Climate Finance

How to finance climate resilience (and tripling MDB lending)

Date: 5 December 2023 | Time: 11:00 a.m. - 12:30 p.m.(local time) |

Venue: The Barbados Pavilion at COP28 | https://www.investbarbados.org/cop28/

Background

The world is fighting its most existential threat with one arm tied behind its back – namely, the selflimited role played by the world’s multilateral development banks in the climate crisis. Climate disasters are now firmly intertwined with development – a hard truth played out repeatedly and tragically recently in Libya, Pakistan and the Horn of Africa. Our system of AAA-rated multilateral development banks (MDBs), with the World Bank at its centre, should be at the heart of climate finance efforts in the developing world. But they are not, yet.

Total lending by the MDBs hovers around $100bn a year. Amar Bhattacharya of Brookings has pointed out that the actual net transfer, once debt repayments are factored in, is currently close to zero. Compare this to estimates by the High-Level Independent Expert Group of the COP Presidencies that a further $2.4trn per year is needed for climate and development finance.

Initiatives to unblock the flow of private capital to green transformation projects in developing countries, such as the proposed partial FX guarantee of the Bridgetown Initiative, are critical. But crucial categories of climate investment do not generate the revenues to interest the private sector, including resilient infrastructure like stronger sea level and flood defences and climate-resilient health and education systems. Addressing climate finance as a system with different needs financed differently is core principle of the Bridgetown Initiative – and the resilience gap is best financed by the MDBs.

We know the size of this gap. The Songwe-Stern report estimates that an extra $200 to $250bn per year is required to save countless lives and livelihoods in the future.

We know how to fill the gap. Join us as we discuss a three-step path to get us where we need to be with minimal additional capital from governments.

In this session of the Bridgetown Initiative series at the COP28 Barbados Pavilion:

Avinash Persaud, one of the architects of the Bridgetown Initiative, will lead a discussion with a high-level panel of experts, kicking off the session by outlining a proposed three step path to triple MDB lending for climate resilience. He will engage the panel to further unpack the issues and discuss what is needed to move things forward, and wrap up with live Q&A with the audience in the Barbados Pavilion.

Speakers / Panelists

- Opening remarks: Dr. Pepukaye Bardouille, Director – Bridgetown Initiative Unit, Barbados

- Moderator: Avinash Persaud, Barbados Special Envoy on Climate Finance

- Hans Peter Lankes - Managing Director and Deputy Chief Executive at the Overseas

- Development Institute a member of the G20 Panel on the Capital Adequacy Frameworks of the Multilateral Development Banks

- Rachel Kyte - Visiting Professor of Practice, Blavatnik School of Government, University of Oxford Dean Emerita The Fletcher School

- Hilen Meirovich, Director Advisory Climate Change, IDB Invest

Climate Finance 101

or why insurance, voluntary carbon credits, green bonds are not (currently) the answer and what is.

Date: 3 December 2023 | Time: 11:00 a.m. (UAE time) | details may be subject to change]

Venue: The Barbados Pavilion at COP28

The Independent High-Level Expert Group and others estimate that the developing world needs $2.4trn of climate finance per year for the foreseeable future. That is twelve times the annual flow of aid to all developing countries on all the Sustainable Development Goals and twenty-four times the annual lending by the multilateral development banks, including the World Bank.

No wonder many reach out to innovation in finance and renewable technology to try and close the gap. Green bonds, debt swaps, carbon credits, parametric insurance, pause clauses, portfolio guarantees and hybrid capital are all mentioned as solutions. Few are understood. Fewer can come anywhere near closing the gap. Some are being pushed by those who stand to benefit commercially. Climate finance is now an industry.

In this session of the Bridgetown Initiative series at the COP28 Barbados Pavilion:

Professor Avinash Persaud, one of the architects of the Bridgetown Initiative and a Member of the Independent High-Level Expert Group, will explain in plain language why what we finance determines how we finance it, what the constraints are, like the current high levels of indebtedness of climate vulnerable countries, what can be scaled, what cannot, what is real and what is illusory. Persaud will set out the reforms to the international financial system and the framework of finance behind the Bridgetown Initiative. Following a short presentation, Prof. Persaud will engage with a live audience, including specially invited guests, to respond to questions and comments.

Ensuring that the multilateral trading system supports the green and just transformation

Date: 8 December 2023 | Time: 01:00 p.m. (local time) | details may be subject to change]

Venue: The Barbados Pavilion at COP28

The multilateral trade system can be a powerful tool in emerging markets and developing economies’ (EMDEs) green and just transformation. But green industrial policy shifts in the Global North are raising competitiveness concerns – the US’ Inflation Reduction Act, EU’s Carbon Border Adjustment Mechanism, and high subsidies to green industry all risk distorting international trade and reducing investment flows to many EMDEs in the short to medium term. The session will bring together global trade leaders to explore the ways in which the multilateral trade system can tackle Global North protectionism and drive climate-positive development in EMDEs. These leaders will set out a path for more equitable green trade policy, reglobalisation to build supply chain resilience, and unlocking South-South trade – including between the Caribbean and Africa.

GREEN PUBLIC FINANCING

*Postponed until further notice due to conflict with negotiations meetings*Date: 5 December 2023 | Time: 01:00 p.m. - 02:00 p.m. | Venue: The Barbados Pavilion at COP28

To be implemented efficiently, Nationally Determined Contributions (NDCs) must be translated into precise and granular government policies and incorporated into medium-term planning and annual budget allocation decisions. Green Public Finance Management aims to facilitate this process.

PFM is concerned with the laws, organizations, systems, and procedures available to governments to secure and use public resources effectively, efficiently, and transparently (North 1991). The importance and specificities of climate change call for the adaptation of existing PFM frameworks. Arguably every single policy adopted by the government has a climate impact, be it direct or indirect. Conversely, every climate policy has an impact, either for the taxpayer or the rate payer. These effects may be significant and should be considered in the context of budget decision-making—not doing so can easily undermine climate commitments.

The concept of “green PFM” can be defined as the integration of an environment- and/or climatefriendly perspective into PFM practices, systems, and frameworks—especially the budget process—with the objective to promote fiscal policies that are responsive to environmental and/or climate concerns. The first few examples of green PFM practices can be traced to more than three decades ago in a few advanced economies. Green PFM received a new impetus in the late 2000s, mostly in fiscally constrained developing countries facing strong climate challenges.

Barbados has undertaken a series of initiatives to mainstream climate risks and climate investment opportunities into its budgeting processes. The Barbados Economic Recovery and Transformation Plan 2022 aims to simultaneously consolidate the gains achieved in debt and fiscal sustainability over the past 5 years and allow for a rapid expansion of green investment. The innovative debt management and green investment initiatives launched by Barbados should prove of interest to all fiscally constrained and climate vulnerable countries.

In this session of the Roofs to Reefs Programme series at the COP28 Barbados Pavilion:

The Roofs to Reefs Programme Director sits down with technical advisors and development partners to explores the role of green public financing in climate action, based on practical experience. Following the panel discussion, the panel will engage with a live audience at the Barbados Pavilion to answer questions and respond to comments.

BLUE GREEN BANK (BGB), BARBADOS

Mobilizing public and private investments in climate mitigation and adaption initiatives

Date: 6 December 2023 | Time: 01:00 p.m. - 02:00 p.m.| Venue: The Barbados Pavilion at COP28

In Concept: BGB is a digital financing vehicle to overcome existing constraints and contribute to climate resilience and adaptation by developing innovative, risk-mitigated financial products and solutions, thereby catalysing private investment to unlock affordable finance through securitisation, bond issuance and other means.

Established as a green bank, BGB will channel international climate finance into Barbados by mobilizing the private sector for mitigation and adaptation investments in line with national priorities and climate vulnerabilities. The BGB presents an opportunity to drive significant GHG emission reduction – far above what is typical of GCF projects and programs – due to the lending facility's revolving nature and the institution's indefinite lifetime.

The BGB will specifically target private and public initiatives for green, affordable, gender-inclusive housing, energy generation, water conservation, food security and low carbon transport. It will create an improved financing capacity and infrastructure that draws in other financing players like banks, credit unions, pension funds, and insurance companies and will build the wider community's awareness in support of a more resilient and sustainable Caribbean. These measures will induce a paradigm shift towards resilient livelihoods and low-carbon technologies, particularly for low-income, vulnerable households and the energy, housing, agriculture and transport sectors. The BGB will become a significant institution for practical and strategic financing of climate change adaptation and mitigation policies and measures, supporting the Government of Barbados to achieve national resilience and emissions reduction targets.

In execution: BGB has received funding approvals from Green Climate Fund (GCF) and Government of Barbados along with financial assistance from USAID and The Rockefeller Foundation. The Bank is currently in implementation phase and is expected to commence activities in 2024.

In this session of the Roofs to Reefs Programme series at the COP28 Barbados Pavilion:

The Roofs to Reefs Programme Director, Ricardo Marshall, sits down with sits down with a core team of technical advisors to discuss the BGB’s role as a catalyst: the original concept - both in terms of finance innovations and possibilities to engage the private sector for upscaling investments in climate initiatives. Following the panel discussion, we will engage with a live audience at the Barbados Pavilion to answer questions and respond to comments.

Speakers:

- Moderator: Ricardo Marshall- Roofs to Reefs Programme Director

- Mr. Craig Cogut, Founder & CEO, Pegasus Capital Advisors,

- Mr. Amit Garg, CEO-designate for BGB

- Professor Avinash Persaud, Special Envoy on Climate Finance,

- Dr. Yannick Glemarec- Special Envoy on CLimate Action and former Executive Director of the Green Climate Fund

THE HOPE PROGRAMME | HOME OWNERSHIP PROVIDING ENERGY

From 200 to 10,000: thinking through the upscaling of a promising flagship resilient housing initiative

Date: 8 December 2023 | Time: 1:00 p.m. (UAE time) | details may be subject to change]

Venue: The Barbados Pavilion at COP28

In Concept: the HOPE Programme combines high quality resilient and sustainable built environment design with an innovative financing model to deliver affordable, resilient homes to low and middle income first time home buyers. Sustainable and resilient design features include solar photovoltaics, passive cooling, hurricane resilient roof design, rainwater harvesting, and low impact on site runoff management. The cost to eligible buyers is reduced because Government, through the state owned enterprise HOPE Inc., provides the land and leverages the cost savings from the solar PVs. Local lenders are providing mortgages with favourable terms, and Government is providing support with legal services. In this way, HOPE offers qualified hope buyers attractive, open-plan, energy efficient and hurricane resilient 2- and 3-bedroom homes at prices significantly below similar offers currently on the market. The Programme also aims to support small and medium sized local contractors by packing and distributing the work to several qualified companies, and taking the opportunity to build capacity in resilient building practices.

In execution: currently, the HOPE Programme is in the pilot stage. The first 200 houses nearing completion. The model units are impressive. Interest is there; it is oversubscribed. Teething problems were encountered, and lessons have been learned. Next steps are being planned - the end goal is 10,000 homes. What is the pathway to that Where do we go from here? What needs to be adjusted? How do the risks change, in nature and magnitude, with upscaling?

In this session of the Roofs to Reefs Programme series at the COP28 Barbados Pavilion:

The Roofs to Reefs Programme Director, Ricardo Marshall, sits down with a core team of technical advisors to dissect the HOPE Programme: the original concept - both in terms of finance innovations and resilience and sustainability in the built environment design - lessons learned from pilot implementation, and thinking through upscaling. Following the panel discussion, we will engage with a live audience at the Barbados Pavilion to answer questions and respond to comments.

Speakers

- Moderator: Karima Degia

- Ricardo Marshall- Roofs to Reefs Programme Director

- Professor Avinash Persaud, Special Envoy on Climate Finance, and

- Dr. Yannick Glemarec – Special Envoy on Climate Action and former Executive Director of the Green Climate Fund